New Costs For Vehicle Registration Begin July 1, What Are The Rules – Know Here

DEBARYLIFE – When renewing their vehicle registrations after July 1, Maryland drivers will need to go a bit further.

As of July 1, new rates will raise the cost of registering a passenger vehicle by 60–75%. Changes to the weight classes of automobiles are among the additional levies that were enacted as part of a budget settlement between the House and Senate.

“In compliance with state legislation, the MVA must modify car registration costs to contribute significantly to the Transportation Trust Fund’s funding, which guarantees that the state’s infrastructure is maintained in good condition,” stated Motor car Administrator Chrissy Nizer.

“To ensure that these new fees are as affordable as possible, the MVA is now providing customers with the convenient choice of selecting a one-year or two-year registration at the time of renewal.”

The goal of the new levies and the upcoming tax on electric and hybrid cars is to address a projected $3 billion funding shortfall in transportation and highway projects. Politicians threatened to postpone projects until the state updated its funding model for transportation-related initiatives early this year.

“A AAA Mid-Atlantic spokesperson, Regina Ali, stated that the organization recognizes that legislators and transportation officials are having to look into alternative funding sources to offset the long-term impact of decreased gas tax revenues as vehicles become more fuel-efficient.”

SEE MORE – Understanding Michigan’s Rainwater Laws: Is It A Collection Legal?

According to AAA, the money raised from the higher car registration charge must be fair, transparent, and committed to addressing the drivers’ expressed transportation requirements. “Funding is critical to support roadway maintenance and transportation infrastructure,” Ali stated.

What Are The Rules?

At the moment, owners of passenger cars up to 3,700 pounds have to pay $137 every two years.

Starting on July 1, a passenger car up to 3,500 pounds will require a $221 registration charge every two years, or $110.50 yearly.

Owners of passenger cars over 3,500 pounds but under 3,700 pounds must pay $120.50 per year, or $241 every two years. It’s a new weight class.

Cars carrying more than 3,700 pounds of passengers will pay $323 for a two-year registration, or $161.50 each year. At the moment, registering a passenger car that heavy would cost $187 every two years.

Starting July 1, 2026, certain car classes will pay an additional fee increase.

Other commercial and noncommercial vehicles will have higher registration costs. The $40 per vehicle portion of the new fees goes toward funding the Maryland Trauma Physician Services Fund as well as the state’s emergency medical system operations, which include the R. Adams Cowley Shock Trauma Center.

Check out the Maryland Motor Vehicle Administration website for a full list of current registration rates as well as the hikes effective July 1.

There will be a second pinch for electric car owners.

The blue-ribbon Transportation Revenue and Infrastructure Needs Committee suggested raising taxes on hybrid and electric vehicles registered in Maryland last year.

In the United States, over 900,000 electric and hybrid cars were sold in 2022. More than 285,000 electric and hybrid cars were registered in Maryland as of April 2024. To fulfill its climate targets, the state hopes to have 1.3 million electric and hybrid vehicles by 2031.

The commission stated in its report from the previous year that by the end of 2024, 137,000 zero-emission vehicles—which includes electric vehicles—should be on the road. As of the end of April, there were 102,530 registered electric vehicles in the state, up 59% from January 2023, according to a report earlier this month from the Maryland Motor Vehicle Administration.

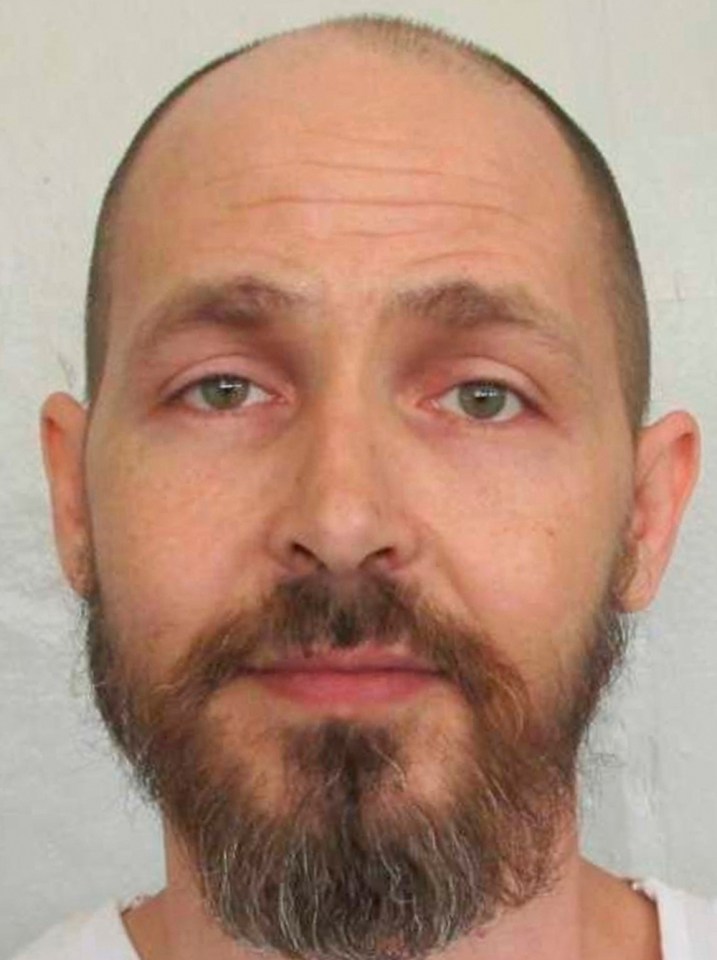

Costs for registering a car will increase on July 1.

On Monday, Governor Wes Moore (D) drives an electric Mustang outside the Baltimore neighborhood of Montgomery Park. The Governor’s Executive Office provided the image.

Maryland Gov. Wes Moore (D) declared last year that by 2035, all new car sales in the state will have to be electric.

Compared to gas-powered automobiles, electric vehicles are heavier. Highway deterioration is increased by the extra weight.

However, the majority of the money that the state raises for the Transportation Trust Fund comes from gas taxes, which owners of those cars do not pay.

The commission’s temporary proposal to impose a fee on electric cars was approved by the legislature. The purpose of the new taxes is to level the playing field for financing road projects between gas-powered and electric-powered vehicles.

An estimate published earlier this year suggested that the new levies, which would be $250 for EVs and $200 for plug-in hybrids every two years, might generate as much as $20 million.

The surcharges are also payable in installments, just like the registration fees.

The timing of the levies’ implementation has not been disclosed. They’re not anticipated to go into effect on July 1.

This year, the TRAIN Commission is anticipated to continue its work. Before the 2025 legislative session, a final report is anticipated.