Girl, 10, earns $2,100 by selling chickens – then bank refused to give her the cash and abruptly closed her account

A FAMILY has entered into a tug-of-war with a bank that refused to give their preteen daughter the money she earned by selling chickens.

Kinley Maner, 10, made thousands of dollars off chickens she raised at her family’s home in Arizona.

She started taking care of the animals in her small town of Thatcher, which is about three hours southeast of Phoenix.

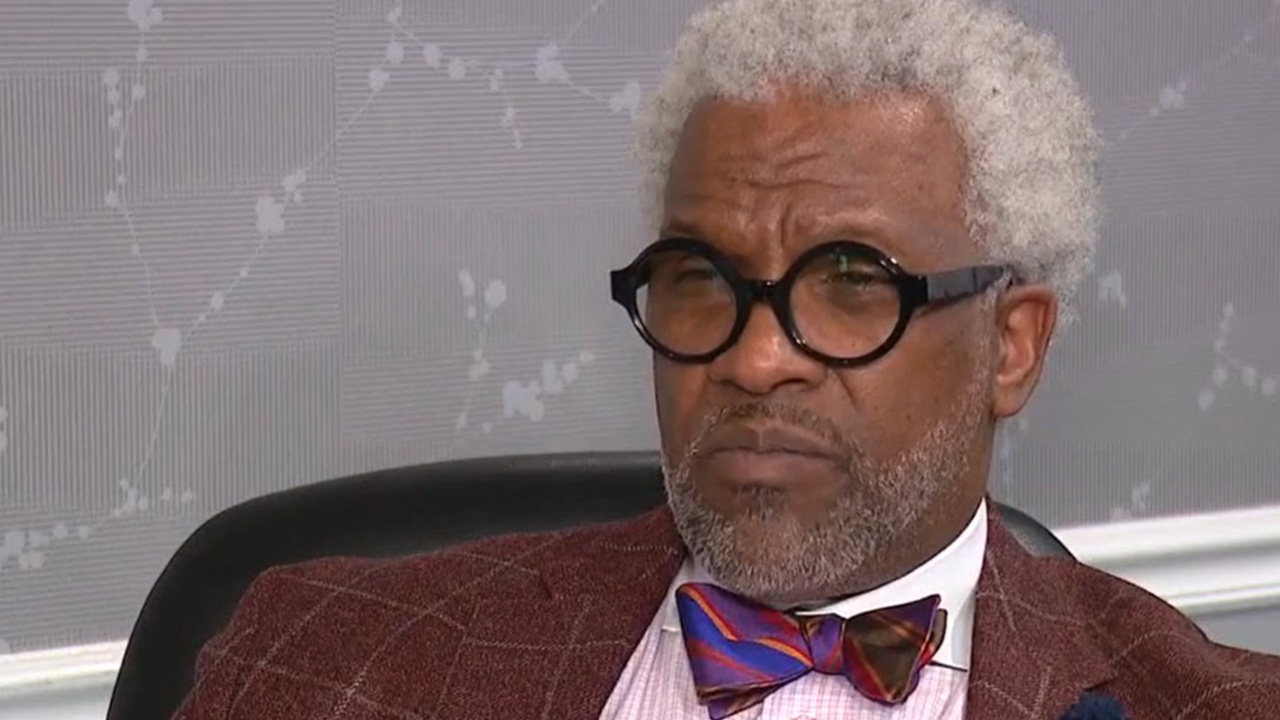

“I just thought that it would be fun because when they’re little, they’re so cute,” Kinley told CBS affiliate KPHO-TV.

Kinley’s parents encouraged her to take on the hobby with hopes it would teach her valuable life lessons.

“She really enjoyed it, had a lot of fun, learned a lot about chickens,” JR, Kinley’s dad, said.

READ MORE ON BANK ISSUES

“It really taught her kind of strict obedience of being out there and taking care of an animal.”

Kinley showed her chickens at the county fair, where she put them up for auction.

The 10-year-old ended up selling six chickens for $2,100.

The buyer wrote Kinley a check, which her mom, Kalli, deposited electronically at Chase Bank.

“So we cashed it,” JR said, adding, “Didn’t think it would be a big deal.”

“And the next day, Chase closed Kalli’s bank account.”

Wells Fargo customer’s ‘heart dropped’ as account was drained of $19,000 in terrifying call – bank said they couldn’t help

The family was shocked to find the mom’s bank account closed – and then they discovered Kinley’s check was frozen, meaning she didn’t get her money.

Kalli spent hours on the phone with the bank, who told her the check was suspicious because it was made out by the Small Stock Association.

The family reported Chase Bank told her they couldn’t verify the check because the phone number associated with the SSA wasn’t in service.

“Their ultimate response is that, sorry, Kinley is not going to get her money back,” JR said.

How to contact your bank

WITH bank scams running rampent, it is important to know how to reach out to your bank without risking fraud.

There is of course the foolproof method of going to your bank in person, but you are likely going to be directed to a customer care phone line.

In order to ensure that you are contacting the bank, make sure to use a phone number given to you by the representative or off of the bank’s website.

Some banks also have online helplines that can securely connect you with a representative.

Conversely, if you think the bank is reaching out to you with an account issue – make sure to verify the concern by calling a bank contact that you know is legitimate.

Scammers commonly mascarade as bank representatives to steal information from frightened customers.

“And there’s nothing we can do unless we can verify that check.”

The family sent SSA in to verify the check to get Kinley’s money back, but the bank still refused to hand it over,

“The guy who wrote the check has gone into Chase three different times, saying ‘Hey, this is me. You can verify it in person,’” Kinley’s mom said.

“And they said the only way to verify it is through that number on the phone.”

Kinley was devastated to miss out on her $2,100, which she planned to put toward her college fund.

“I was a little bit upset because I deserved that money, and it was supposed to be mine,” she said.

Her dad added, “She’s a ten-year-old girl who worked hard for this money. And we think that she deserves to get the money that she rightfully earned.”

WINGING IT

However, over a year after the tug-of-war began, the family contacted KHPO’s On Your Side team to seek answers.

Just hours after the journalists reached out to Chase, the bank contacted Kinley and her family to apologize and make it right.

The bank quickly sent the family a $2,100 check.

“I was surprised when I got it, but I also was excited,” Kinley said.

Read More on The US Sun

JR said the resolution wouldn’t have happened if KHPO-TV hadn’t looked into it.

The U.S. Sun has reached out to Chase Bank for comment.