Act Now: Sales Tax-Free Offer on Disaster Preparedness Essentials Until June 14th

Important Information:

– The 2024 Sales Tax Holiday for Disaster Preparedness is valid through June 14th.

-Many preparedness supplies are free from sales tax throughout the state during this time.

– See how neighbors are utilizing the tax break by watching the video.

Transcript of a Broadcast:

Now that hurricane season has officially arrived, getting ready is necessary.

Woodville neighbor Cynthia Tucker: “I’m not scared; I’m just going to be a little more organized.”

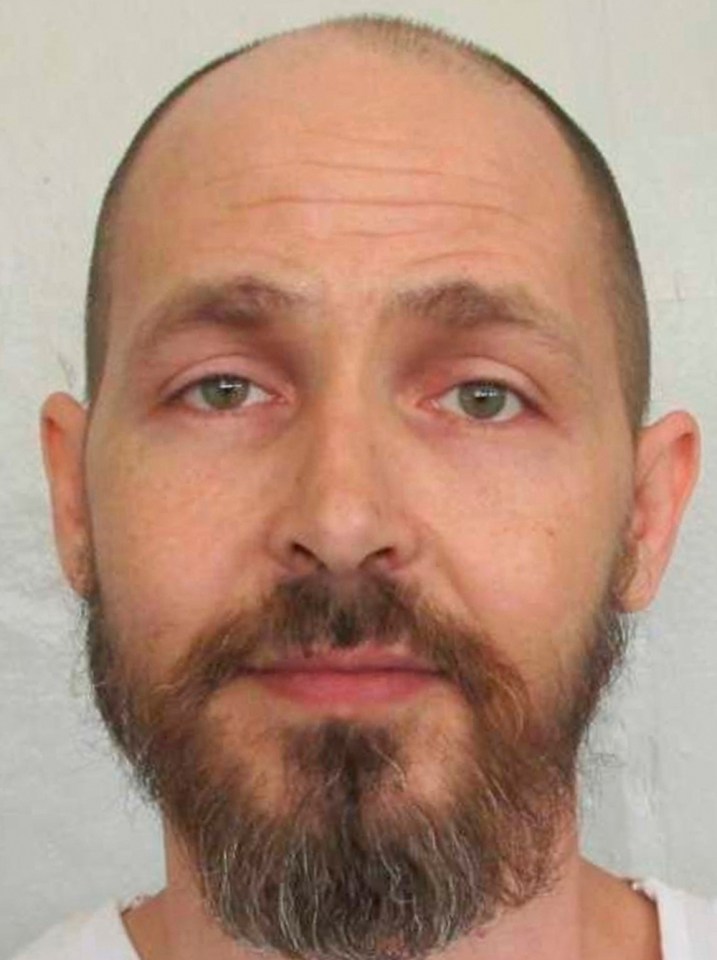

I’m Kenya Cardonne, the neighborhood reporter for Southeast Tallahassee.

Additionally, Florida is hosting the 2024 Disaster Preparedness Sales Tax Holiday, which will assist neighbors in preparing for what may be an active season.

“Tallahassee has been that zone that always kind of gets missed, but with this storm, I think people are taking the storm season a lot more seriously and they’re buying more,” says Devin Crockett, an employee at ACE Hardware Woodville.

Devin Crockett, an employee of ACE Hardware Woodville, tells me that as hurricane season approaches, business is picking up.

SEE MORE –

Central Florida Readies for Disaster Preparedness Sales Tax Holiday Starting June 1

“We woke up to a war zone,” said Tucker.

After recent tornadoes destroyed homes and hearts in Tallahassee, neighbors say they’re learning from their mistakes.

Woodville neighbor Katrina Ward: “Well, I think it just makes me more aware that I need to be fully prepared because bad weather can strike at any time.”

Tucker: “I’m going to pick up some things while I’m here, especially since I came down to ACE to find out that they have this tax relief on items.”

The hurricane season officially began on June 1st, coinciding with Florida’s 14-day Disaster Preparedness Sales Tax Holiday, during which residents of the state can purchase certain preparedness supplies tax-free.

Items Exempt from Taxes List:

$10 or less • Individually packaged wet dog or cat food, or the equivalent when sold in a box or case

$15 or less

• Pet food or water dishes that are collapsible or travel-sized; • Cat litter pans; • Pet waste disposal bags

• Substance for hamsters or rabbits

$20 or less; reusable ice; pet collars, leashes, and muzzles; and pet pads

$25 or less • 25 pounds or less of cat litter

$40 or less: Self-powered, transportable light sources

• Pet beds

$50 or less

• Fuel tanks for gasoline or diesel; two-way radios; weather-band radios; and portable self-powered radios

• Only the sizes of the batteries stated, including rechargeable batteries: AA, AAA, C, D, 6-volt, and 9-volt batteries

$60 or less; portable power banks; nonelectric food storage coolers

Smoke alarms or detectors $70 or less; fire extinguishers; detectors for carbon monoxide

Tarps or other flexible waterproof sheets; ground anchor systems; and less than $100

• Transportable pet carriers or kennels

• 50 pounds or less of dry dog or cat food

> Pet over-the-counter drugs

• Portable generators used for illumination, communications, or food preservation during a power outage that cost no more than $3,000.

I talked with Woodville neighbors who are benefiting from the tax relief.

Ward: “It saves a lot, especially if you need a lot, but I’m set for now because I’ve done that before.”

Tucker: “In my opinion, this is merely a beneficial inducement for the government to provide to citizens, as not all individuals have the same income levels.

Additionally, as I previously stated, I believe that taxpayers ought to receive additional benefits regardless.”