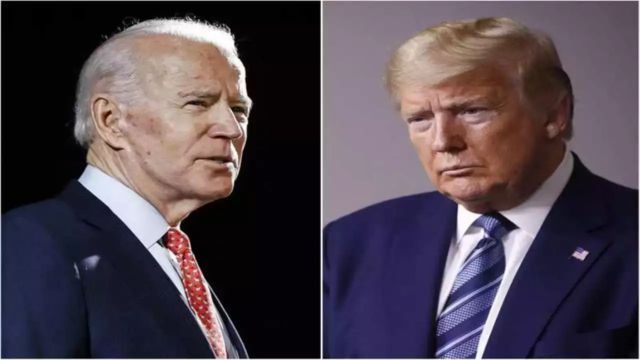

Biden Praises U.S. Economy as World’s Best, Trump Disagrees

Debarylife – President Joe Biden is battling to persuade citizens who are weary of inflation that the US economy is doing well.

He stated on NBC’s “TODAY” show on Monday that “America has the best economy in the world,” outlining a key point of contention for his reelection campaign.

The United States’ economic status is increasingly becoming a topic of contention during the campaign trail, as former President Donald Trump frequently portrays the country as a commercial wasteland.

Trump said, “We are a nation whose economy is collapsing into a cesspool of ruin, whose supply chain is broken, whose stores are not stocked, whose deliveries are not coming,” last month during a rally in Georgia.

However, the data presents a different image, one that is more consistent with Biden’s thesis of US economic supremacy than Trump’s dire predictions.

Although it has increased slightly over the last several months, inflation has decreased significantly from its peak in 2022.

Federal Reserve Chair Jerome Powell stated on Wednesday, “It is too soon to say whether the recent readings on inflation represent more than just a bump.”

According to an IMF assessment from January, the United States’ gross domestic product expanded by 2.5% in 2023, much faster than that of other major economies. Although it anticipates a decline in the rate to 2.1%, the IMF predicted that the United States would maintain its dominance in 2024.

SEE MORE: Trump’s Legal Battles Intensify: Two Courtrooms Rule Against Him Today

Germany and Canada, two additional sizable advanced economies, grew their GDP at a negative 0.3% and 1.1%, respectively, in 2023.

“The world economy is following the lead set by the American economy. It’s propelling the world economy,” Mark Zandi, chief economist of Moody’s, said to CNBC.

Economists continue to be alarmed by the statistics in developed countries across the globe, notwithstanding the erratic decline in U.S. inflation. For instance, in 2023 the consumer price index increased by 3.9% in Canada and 5.9% in Germany.

Because different countries compute inflation in different ways, direct comparisons are challenging.

According to Zandi, the United States appears to be doing well in terms of inflation even after accounting for the disparities in the calculations.

“Using the same methodology as let’s say the European Union, the Fed’s already at target, inflation is already below 2%,” he stated.

SEE MORE: Exclusive! Trump Previews Upcoming Abortion Statement, Suggests Public Reaction Will Be Predictable

Additionally, the job market has remained robust despite the rise in interest rates. Payroll processing company ADP announced on Wednesday that U.S. private employers gained 184,000 jobs in March, much exceeding the upwardly revised forecast of 155,000 jobs by the Dow Jones. The U.S. economy has not seen employment growth this quickly since July 2023.

Over the previous few months, the stock market has likewise had record increases and house values have skyrocketed, albeit they have now started to fall as inventory levels have improved.

In addition to persistently high prices that are expected to decline in the upcoming year, Zandi stated that the current state of the U.S. economy’s fundamentals are almost perfect: “The economy is in excellent shape. It’s difficult to dispute it.

“Luck and Policy”

The current outperformance of the US economy is the consequence of multiple reasons.

Economist Joseph Gagnon of the Washington, D.C.-based Peterson Institute for International Economics stated, “It’s both policy and luck.”

The American government responded to the pandemic’s economic shock by pumping almost $4 trillion in stimulus money into the economy to help private citizens and small companies.

SEE MORE: Trump Media’s Nasdaq Debut Marred by Auditor Concerns and Operating Losses

Economist Josh Gotbaum, a former Treasury Department official in both Republican and Democratic administrations and current guest scholar at the Brookings Institution, said, “We had more fiscal stimulus than any other country and that is part of the reason why the U.S. has recovered from the Covid depression better than any other country.”

The cost of America’s stimulus safety net was high, and as a result, the country’s budget deficit was far higher than that of other nations. However, it also kept the economy afloat by acting as a buffer, preventing businesses from having to carry out large-scale layoffs that could have triggered a recession.

That labor market toughness has endured. The unemployment rate has not exceeded 4% over the last two years, despite a substantial increase in interest rates by the Federal Reserve in February.

In the meantime, Canada’s unemployment rate increased by 1 percentage point from January to 5.8% in February. Eurostat reported that the unemployment rate in the European Union was 6.0%.

The durability of the American economy in the face of geopolitical crises and the distinctive structure of the American financial system have also contributed to its standing on the international scene.

For example, the United States was not as badly impacted by Russia’s invasion of Ukraine as regions like Europe and Japan, which depend more largely on Russian energy and food supplies, were.

It’s the lucky part, according to Gagnon.

One reason for the U.S. economy’s resiliency is its distinct debt structures.

Because the 30-year fixed-rate mortgage lets homeowners lock in exceptionally low mortgage rates from the early days of the pandemic, U.S. consumers were more protected from surges in global rates. Households were safeguarded when rates subsequently increased by that 30-year mortgage rate, which is primarily exclusive to the American financial system.

“Our banking system takes a lot of interest rate risk, but in the rest of the world, they shove it onto the household, on to businesses,” stated Zandi. “That was important this go around.”

‘Free and clear’ Not Quite Yet

There is still potential for setbacks in the recovery, even while the US economy continues to outperform those of the rest of the developed world.

“I don’t think we can conclude that we’ve soft-landed, that we’re free and clear,” Zandi added.

Notwithstanding prior signals that it would implement three rate reductions this year, the Federal Reserve is still now maintaining a hawkish stance on interest rates.

Raphael Bostic, the president of the Atlanta Federal Reserve, now anticipates just one rate reduction this year, most likely in the fourth quarter.

In an appearance with CNBC’s “Squawk Box,” Bostic stated on Wednesday, “The road is going to be bumpy.”

Even though it’s still unclear how the US economy will rebound, experts remain upbeat.

According to Gagnon of the Peterson Institute, “We’re basically on or above the track we were on before the pandemic hit.” “So that’s pretty darn good.”